Check your mailbox and hold your breath–the notice of appraised values were sent out on Wednesday.

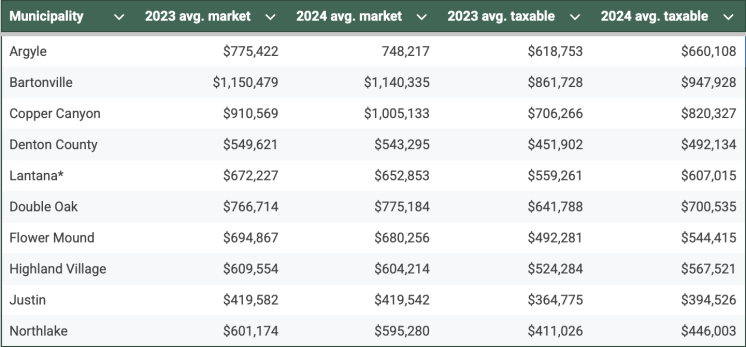

According to the Denton County Appraisal District’s average residence value report, Bartonville and Double Oak’s average property values increased while others decreased.

The average market value is the average value of all properties in the area. The average taxable value is the average property value that taxes are paid on.

Denton CAD explains that the averages are computed by taking the number of residences with a homestead exemption, averaging the homesite value and subtracting the average exemption from it to arrive at the average taxable.

The increased taxable value is usually because there is a decrease in homestead exemptions. Rental homes, vacation properties, investment properties and commercial properties are not eligible for homestead exemptions, so they could increase the taxable value in an area.

Data in the table is based on valuations from July 20, 2024, which includes the amount of homestead residences and the average homestead exemptions.

The Denton CAD has a process for protests on its website. The deadline to file a protest is May 15 or 30 days from the mailing date of your notice, whichever is later.

If a resident didn’t receive a Notice of Appraised Value in the mail, they can check online at the property search tool or the public portal on the Denton CAD website.

Taxes collected from property taxes don’t go to the state, they are distributed to local governments that spend it on schools, roads, hospitals and other departments.

For more information, go to the Texas Comptroller’s website or the Denton CAD website.