A split Flower Mound Town Council voted Monday night to create the town’s second Tax Increment Reinvestment Zone, this one to help fund infrastructure in the west side of town before expected major development begins.

A TIRZ is an economic development tool available to local governments to finance needed public improvements within a defined area, according to the town. The improvements usually are undertaken to promote the viability of existing businesses and to attract new commercial enterprises to the area. The cost of improvements to the area is repaid by the contribution of future tax revenues by each taxing unit that levies taxes against the property. Specifically, each taxing unit can choose to some of the tax revenue that is attributable to the increase in property values due to the improvements within the reinvestment zone.

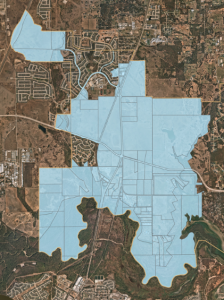

The TIRZ area includes 3,962 acres around the area of Hwy 377 and FM 1171. It will take effect immediately and terminate at the end of 2053, unless otherwise terminated. The ordinance also creates a seven-member board of directors for the TIRZ, to be appointed by Town Council.

Three council members — Ann Martin, Jim Engel and Brian Taylor — voted to approve the ordinance. Adam Schiestel and Chris Drew voted against it.

Engel pointed out that creation of the TIRZ does not obligate any current taxpayers living outside the district, it is obligating future tax dollars of those who live within the TIRZ.

“It limits the existing town residents and property owners outside the TIRZ from footing the bill for $380 million of town infrastructure, which is going to be required,” Engel said.

Martin pointed to the fact that the TIRZ would not keep all of the future tax revenue coming from west Flower Mound from the town’s General Fund.

“50% will be going to the General Fund,” Martin said. “The money we collect in the future within the district, half of it will stay to be spent in the district on projects that we as a town are obligated to provide, and then the other 50% will come to the General Fund. In my opinion, it is a very equitable division of the assets that still will be coming to the town.”

Taylor said the development is coming, and the TIRZ won’t make it happen any faster.

“The infrastructure is not there in that area to support the proposed growth and the zoning out there,” Taylor said. “We, as a town, are responsible for installing that infrastructure … it’s not going to encourage the development to happen any quicker.”

Schiestel pointed to the city of Frisco, which he said has four active TIRZ districts and much higher residential property tax compared to Flower Mound.

“15% higher home values, 15% higher tax rate really undercuts the argument, in my opinion, that fostering commercial development will take the burden off our residential property owners, especially when we’re partitioning it into another bank account where it doesn’t impact our tax rate calculation,” Schiestel said. “I just don’t think we’re in line with our constituents by adopting this TIRZ.”

GIF.gif)